If you want money, ask for advice

For the last 3 years I have been helping start-ups and early stage companies raise investment finance in the equity gap.

Having been through a successful trade exit (Century Dynamics, sold in 2005 to ANSYS (NASDAQ: ANSS)), I am often asked: “Why have you not made investments in the companies that your are helping?”. The short answer, for most cases, is that I cannot: As a Portfolio Director, with the Innovation & Growth Teams, I am paid to be a impartial supporter to companies and to sit on their side of the table.

Now, I have helped in my spare time, other entrepreneurs and companies who fall outside the remit of my day job with the Innovation & Growth Team which has a geographical boundary. So there is a longer answer and angel investing was something I considered. However back in 2006 my personal enquiries into angel investing led me to the apparent collective wisdom that:

- You need to make at least 10 investments to hedge your bets

- One should expect only one of those 10 investments to do very well and compensate for complete losses on 6 or more of the others

- Investing as part of a syndicate (group of angels) is likely to be more successful

- Only invest money which you would not lose sleep over losing

So on balance the priorities of investing in my young kids or making 10 investments and not worrying about losing all the money were clear.

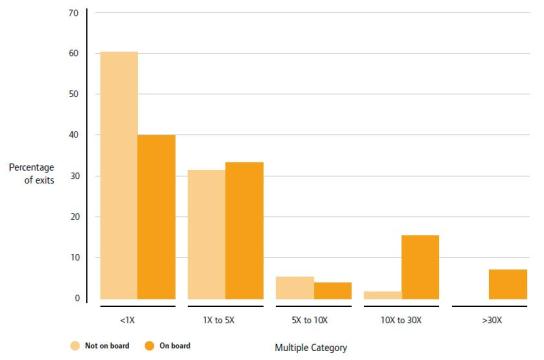

More recent research in a report “Siding with the Angels” by NESTA backs up what I learnt a few years before: “In the UK, 9 per cent of the exits produced 80 per cent of the cash returned. In the US, 10 per cent of the exits produced 90 per cent of all the cash returned”. Other conclusions from that report are:

- Angels with entrepreneurial expertise outperformed those without it, especially in earlier-stage opportunities

- Those who invested in opportunities where they have specific industry expertise failed significantly less

- Those who perform at least some due diligence, even just 20 hours, experienced fewer failed investments

- Post investment some involvement with the venture was related to improved investment outcomes

Over time, I have come to regard the “collective wisdom” in numbered points 1 to 3 above as being rather pessimistic in outlook. Wise perhaps but it rather comes across to me as being all about risk management rather than opportunity creation. After all, there are other ways to balance your investment portfolio which I won’t go into here. Some other aspects of some angel investor behaviour also irritate me:

- Lack of interest in meeting with the entrepreneurs face-to-face early on. Why assess a business plan when the business is run by people. Business models and plans can and do change. People don’t change much! If I want to hear about an investment proposition I would rather hear a pitch by a CEO than receive a business plan.

- Lack of politeness: Many angels do not even bother to send any response to propositions unless they are interested and currently investing. Nobody is too busy to write a short email of response simply saying: “Thanks for sharing this short investment proposition with me. It’s not really for me this time but I wish you well in your efforts”. I can understand sending no response to unsolicited, dreadfully prepared and presented, propositions. But is this wise, on the part of the angel, to a well prepared solicited proposition?

- Middle men: Those who will take an upfront fee to introduce you to their network of investors and then take a success fee (typically 5%) of the money raised. If you are good enough at this why do you need an upfront fee? Some of these people are great but many are a waste of space. I could do a whole rant on this topic alone but it’s been done by others notably Jason Calacanis here.

So what would interest me enough to invest? You may ask, and my answer is, in rough order of importance:

- A great CEO and/or founding team

- An idea , technology or business model with disruptive potential

- A business where I can contribute with much more than money

- A business that through success makes the world a better place

- A new interesting challenge where there is an opportunity to learn and grow

And, of course, since it’s an investment a big potential upside and good return.

Well after four years of mentoring entrepreneurs, working closely with around 100 early stage businesses and interacting with angel investors, I have now made an investment for an exceptional case.

Three months ago at a TWiST (This Week in Startups) London event I saw 4 great pitches by @Teamly, @opentwit, @campingninja and @Tripbod. You can read more about this great little event organised by all action Steve Schofield of @Fidgetstick here. The video for the winning pitch by Sally Broom, founder and CEO of Tripbod is here. To say, I was impressed would be an understatement and afterwards in conversation with Sally she enquired as to whether I was an investor and I replied that I wasn’t, explaining some of the reasons why. Shortly afterwards she asked me if I could provide some advice. Naturally, I was delighted to be of help to enthusiastic entrepreneur with a interesting business. In short, this led onto much interaction over several weeks. It was clear that advice and guidance was helpful to them but some financial support was required too. I really did want to help and by this time had got to know Sally and the business well. It just goes to show that the old adage “If you need money, ask for advice” does work!

This whole process has reinforced my contention that you should invest in people first. Sally has many great attributes but perhaps most of all she is relentlessly resourceful. The same applies to her co-founder Liz. So what is Tripbod?

- A Tripbod is a trusted local person, with local knowledge, who can help you plan your trip before you go

- Tripbod provides on-line personalised bespoke trip planning across the globe

- The one-to-one service includes unlimited on-line contact with your Tripbod through a private trip planning page and personal calendar before you go

Some of you may be wondering whether I have any relevant industry experience to contribute to Tripbod. Well, I don’t. I can certainly claim to have a lot of experience of international travel both as an independent tourist and businessman. However, no worries there, as I am being delighted to be joining as an investor and active board member with Martin Dunford, who was a co-founder of Rough Guides, and who stayed with them through acquisitions by Penguin and Pearson until last year.

No doubt, I’ll be blogging about progress with Tripbod in future posts, so I’ll leave it there. If you’ve read this far, thank you for your interest. We would love your feedback on what you think of Tripbod. Would you use it? Do you think a local travel expert can enhance your next trip? Let us know here.

Read Full Post | Make a Comment ( 16 so far )